Contents

The first one is a long-body candle, representing a large rise in price with the close price settling above the open price. This bullish candle reflects an upward momentum of the asset price. The Evening Star candlestick pattern is one of the most common and reliable patterns in technical analysis.

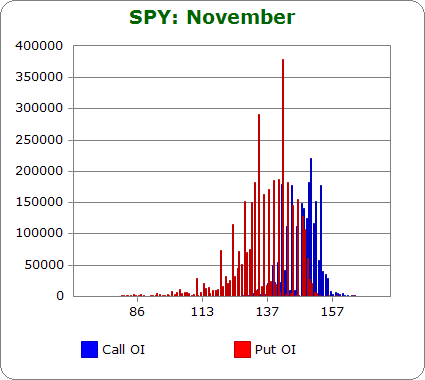

Determine significant support and resistance levels with the help of pivot points. Access to real-time market data is conditioned on acceptance of the exchange agreements. Professional access differs and subscription fees may apply. Futures, futures options, and forex trading services provided by Charles Schwab Futures & Forex LLC. Trading privileges subject to review and approval. Forex accounts are not available to residents of Ohio or Arizona. Futures and futures options trading involves substantial risk and is not suitable for all investors.

One way to resolve this is by looking for the Evening star formation within an area of resistance. Bullish Candlesticks vs. Bearish CandlesticksTo recognize is trading 212 legit an evening star chart, you need to be familiar with the above graphic. To understand price action on any candlestick chart, this is basic knowledge.

Trading Stocks

These candles should be a dark and must close well with the previous candle. I put a rectangle around the daily RSI above 70 and where the evening star appeared on the previous chart. Steve Nison, author of “Japanese Candlestick Charting Techniques,” makes this point clear in his book. The book is a classic and well worth your time if you want a better understanding of candlestick charts. The second candlestick is short and in this case, it’s green, or bullish.

Also unique to Barchart, Flipcharts allow you to scroll through all the symbols on the table in a chart view. While viewing Flipcharts, you can apply a custom chart template, further customizing the way you can analyze the symbols. Unique to Barchart.com, data tables contain an option that allows you to see more data for the symbol without leaving the page. Click the “+” icon in the first column to view more data for the selected symbol.

This, in turn, helps traders confirm price levels at which they can enter or exit the market and place stop-loss orders according to the market volatility. On the other hand, take profit orders can be placed right below the bearish candlestick or at the opening level of the candlestick that occurs as a downtrend begins. The opposite of the Evening Star Foreign Stocks & Emerging Markets pattern is the Morning Star pattern that occurs after the price has moved lower significantly. Consequently, the bullish reversal pattern indicates prices are likely to bottom out and move up as part of an emerging bullish trend. As we can see from the far left corner of the chart, the price began trading sideways creating a W shape formation.

Hanging Man Candlestick Pattern (How to Trade and Examples)

Candlestick patterns can be classified as continuation patterns, or reversal patterns. In this lesson, we are going to examine a popular reversal candlestick formation known as the Evening star pattern. However, the second day was still a wavering day between bullish and bearish sentiment. If there is a gap down when the market opens on the third day, it indicates that momentum will reverse and traders have made a short decision.

Traders will see the daily opening and closing prices, as well as the highest and lowest prices. Big bearish candle – This candle shows the first sign of new selling pressure. In the non-forex market, this candle opens downwards from the closing price of the previous candle, marking the beginning of a new downward trend.

Triple Top Pattern: How to Trade and Examples

But it should be noted that the higher time frames such as the eight hour, daily, and weekly tend to perform the best. Additionally, markets that are displaying mean reversion characteristics tend to outperform as well using this methodology. Sometime later, we can see a major engulfing pattern which thwarts the upward price move, causing prices to back off and retrace lower. From here, prices consolidate and move in a sideways manner. A clear swing high resistance level can be recognized at this point.

- Also unique to Barchart, Flipcharts allow you to scroll through all the symbols on the table in a chart view.

- The Evening Star pattern is a type of reversal pattern of asset price charts.

- The sentiment will change during the middle of the second day when the bulls fail to make further headway.

The star is the first indication of weakness as it indicates that the buyers were unable to push the price up to close much higher than the close of the previous period. As it has a small real body, the color of the star is not important. This weakness is confirmed by the candlestick that follows the star. This candlestick must move against the uptrend and, hence, must be a black candlestick that closes well into the body of the first candlestick. When the star is a Doji, this formation is called the Three-Rivers Evening Doji-Star or an Abandoned Baby Top if it gaps away from both the first and the third candlesticks. As an informative sidenote, a doji is created when the opening and closing prices are approximately equal.

However, it can be difficult to discern amidst the noise of stock-price data. To help identify it reliably, traders often use price oscillators and trendlines to confirm whether an evening star pattern has in fact occurred. It also appears in an uptrend and reverses after the third bearish candlestick is formed, providing stock charts macd traders with ideal sell/short signals. The Evening Star and Shooting Star patterns are almost the same. Both are bearish reversal candlestick patterns that occur after a significant price move. The only difference between the two patterns is in the second candlestick as part of the three candlestick patterns.

Evening Star and Shooting star patterns

Our exit strategy calls for setting a target at the level where price reaches two times the length of the entire Evening star structure. You can reference the lowermost maroon bracket which represents our intended target level and exit point. Once again, this Evening star reversal strategy provided for a profitable trade.

In this case, will be utilizing the 50 day SMA as a mean reversion mechanism, and seek to fade the price action above the 50 day SMA. Notice that around the same time that the Evening star pattern was nearing its completion, the RSI reading had emerged into overbought territory, exceeding the upper threshold of 70. This would have provided an excellent opportunity to short the market immediately following the completion of the Evening star formation. Even though prices consolidated a bit after the pattern completion, the price ultimately moved lower as we would have anticipated. Starting from the far left within this price chart, we can see that the prices were moving higher in a stairstep manner.

Predicting upward or downward market movement can help traders with accurate price analysis for exiting or entering the market. The High Wave Candlestick pattern occurs in a highly fluctuating market and provides traders with entry and exit levels in the current trend. The emergence of a third large bearish how to interpret macd signal affirms the shooting star pattern, signaling bears have overpowered bulls and are set to push prices higher. The Doji does not in any way signal a reversal is about to happen. In most cases, the Doji candle indicates the market can go anywhere as buyers and sellers fight for supremacy.

Evening Star

Despite its popularity among traders, the evening star pattern is not the only bearish indicator. Other bearish candlestick patterns include the bearish harami, the dark cloud cover, the shooting star, and the bearish engulfing. Different traders will have their own preferences regarding what patterns to watch for when seeking to detect trend changes. When trading the evening star pattern, it’s important to look for confirmation of the pattern before entering into any trades.

The Evening Star Candlestick Pattern For Technical Analysis

In a short position, your stop-loss is higher than your entry price. Then, wait until the third candlestick confirms the pattern. Remember, the RSI is calculated using a certain number of periods — 14 is most common. The shorter time frame on this chart magnifies price action in the RSI.

Charles has taught at a number of institutions including Goldman Sachs, Morgan Stanley, Societe Generale, and many more. Past performance of a security or strategy is no guarantee of future results or investing success. Free members are limited to 5 downloads per day, while Barchart Premier Members may download up to 100 .csv files per day.